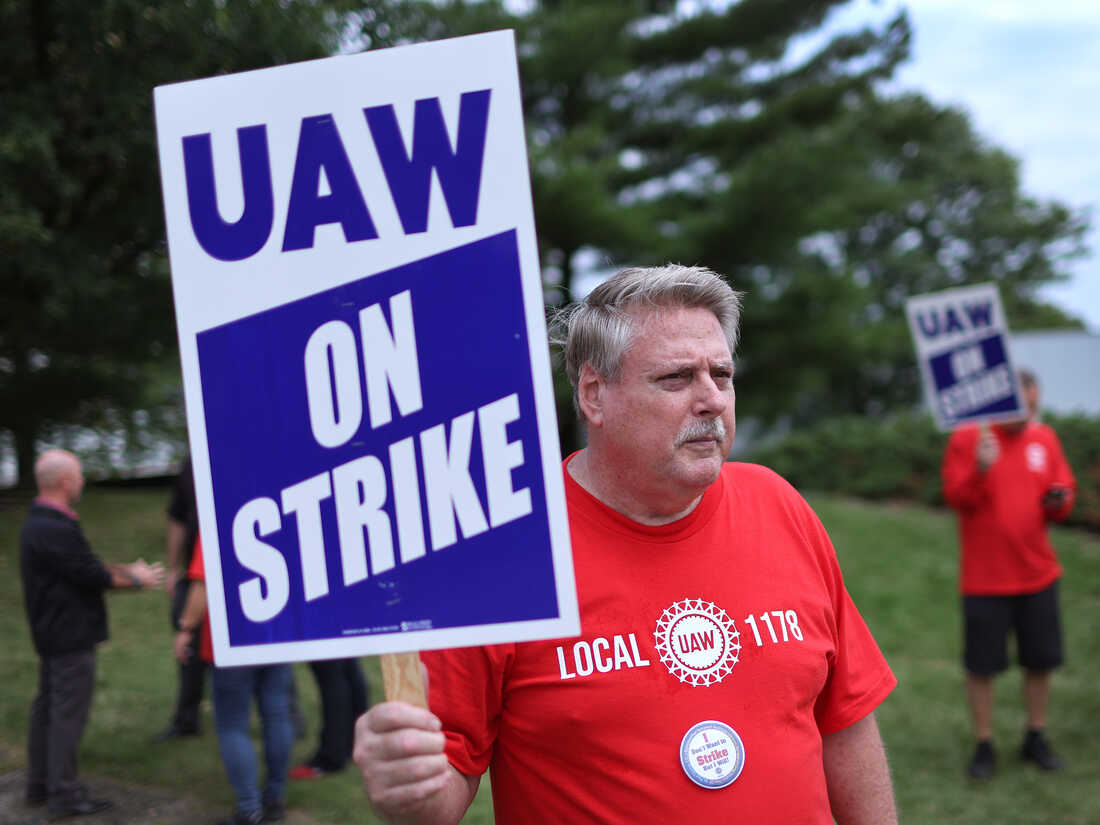

UAW workers on September 22, 2023 in Naperville, Ill. Picketed outside the Stellantis Mopar Parts store in A UAW strike against the Big Three automakers won’t have a big impact on car shoppers, though that could change.

Scott Olson/Getty Images

Hide title

Change the title

Scott Olson/Getty Images

UAW workers on September 22, 2023 in Naperville, Ill. Picketed outside the Stellantis Mopar Parts store in A UAW strike against the Big Three automakers won’t have a big impact on car shoppers, though that could change.

Scott Olson/Getty Images

A United Auto Workers strike against three Detroit-based automakers is making history — but the impact on car buyers won’t be as great, at least not yet.

Analysts say the strike risks eventually reducing supplies and driving up prices, but it will take a long time to materialize.

On the other hand, parts shortages can be felt very quickly and repairs take longer for some vehicle owners.

Here’s what you need to know about how strikes affect drivers.

Stellantis and GM dealers may struggle to find parts

On Friday, the UAW announced a major shift in strikes.

It expanded the strikes to Stellandis in 20 states and 38 parts distribution centers for GM — but not Ford, citing progress in negotiations.

These centers are basically warehouses that ship parts to dealerships. That means that while these new strikes won’t cause much disruption to auto production, they will quickly begin to interfere with auto repair.

Pete DeVito is with the union that represents workers at car dealerships. He says it’s a big expansion of the UAW, especially from a car owner’s perspective.

Cars in need of repairs sit at dealerships or body shops “for two months, three months, two or three weeks because they can’t get a part,” he says. “Now, in some cases, dealers — just like with cars — keep as many parts in stock as they can get their hands on … but that lasts a long time.”

Cars are displayed for sale at a CarMax dealership in Santa Rosa, California on April 11, 2023. Although the union surprised the auto industry by striking simultaneously against all three companies, its plan was to gradually increase the plants or affected facilities. .

Justin Sullivan/Getty Images

Hide title

Change the title

Justin Sullivan/Getty Images

Cars are displayed for sale at a CarMax dealership in Santa Rosa, California on April 11, 2023. Although the union surprised the auto industry by striking simultaneously against all three companies, its plan was to gradually increase the plants or affected facilities. .

Justin Sullivan/Getty Images

He notes that this is a recent experience for the industry. In 2019, the UAW’s 40-day strike against GM disrupted parts shipments with lasting effects. “It’s not going back into place,” DeVito says. “It’s going to take months to deal with the deficit that’s going to be created.”

GM and Stellantis have options to try to minimize the impact — like sending white-collar workers to try to run parts facilities.

But DeVito doubts that will be enough to avoid disruptions to repairs. Popular vehicles affected include GM’s Chevrolet, GMC, Buick and Cadillac brands, along with Stellar brands Jeep, Chrysler, Ram and Dodge.

Rising inventories provide a buffer against rising prices

The strike may soon be felt in auto shops too. But at the sales desk, it should be business as usual now.

The number of vehicles already built and ready for sale, a closely watched metric in the automobile industry, crossed the 2 million mark for the first time in two years.

Historically, it is still not high. Some of the vehicles targeted by the strike—for example, the Ford Bronco—were in short supply to begin with. But overall, America isn’t on the brink of a car shortage like it was just a few years ago.

“Given current inventory levels, we do not expect a short-term strike to affect consumer prices in any meaningful way, at least in the near term,” Rebecca Rydzewski, research manager at Cox Automotive, wrote last week.

The strike is also targeted, minimizing the impact on supply

The nature of the strike should now minimize the impact on the Big Three supply chains.

Although the union surprised the auto industry by striking simultaneously against all three companies, its plan is to start with reduced locations and gradually increase if automakers don’t make enough concessions.

The UAW strategically chooses targets with relatively limited ripple effects.

For example, instead of shutting down the Big 3’s operations entirely by halting engine production, the union focused on a few assembly plants and warehouses that supply dealerships, not the factories themselves.

Tony Hanes, a self-employed mechanic, selects used car parts at a salvage automobile at Pull-A-Part in Louisville, Kentucky on January 13, 2022.

John Cherry/Getty Images

Hide title

Change the title

John Cherry/Getty Images

Tony Hanes, a self-employed mechanic, selects used car parts at a salvage automobile at Pull-A-Part in Louisville, Kentucky on January 13, 2022.

John Cherry/Getty Images

Even after factoring in knock-on effects that caused a few thousand temporary layoffs, most manufacturing facilities are still operating.

The F-150, Silverado and Ram pickup trucks profit from the Big Three and, in particular, are manufactured seamlessly.

The Big 3 is not as big as it used to be

Decades ago, Ford, GM and Chrysler accounted for 90% of the domestic auto market. But that is ancient history today, with Toyota, Honda and Hyundai leading the market and the big three accounting for just 39% of the market.

That means the union has less power than at its peak. This makes this strike very different from the massive, industry-wide supply disruption triggered by the pandemic.

Unlike the Covid shock, Cox Automotive chief economist Jonathan Smoak notes, the UAW strike “will affect only a portion of the retail business, and the impact will come slowly.”

Potential impact: No holiday discounts

Aside from the shortage of specific models, the lack of incentives at the Big Three automakers is likely to have an impact on consumers — zero-down-payment, 0% interest loans and cash-back offers are slowly returning, analysts tell NPR. For dealership ads.

Ed Kim, an analyst at AutoPacific, said the strike “will help prevent the Big Three from piling up year-end incentives to move this metal out.”

On the other hand, he says, car buyers accustomed to this brutal car market may not expect discounts.

A prolonged strike may be a different story

If the strike grows large enough and lasts long enough, there could be more significant effects on vehicle supply and prices.

“We don’t know at this point,” Jessica Caldwell, managing director of insights at Edmonds, an automotive data company, told NPR on the sidelines of the Detroit Auto Show last week. “If it drags on, it’s definitely a risk.”

Rivals like Toyota could see this as an opportunity to capture market share, which could mute price implications, he notes. But they can actually increase productivity enough to seize their moment.

It all depends on which plants are attacked and for how long.

Labor costs are not the driving force behind prices

When will the strike end? A deal with big wins for the union, if it happens, will increase the cost of building a car.

But now, automakers are selling cars and trucks — especially their biggest, most profitable models — Very much More than it costs to make them. And the union knows it all too well.

“Car prices have been going up for years because of corporate greed,” said Kyle Bendert from a picket line outside a Ford assembly plant in Wayne, Michigan. “When car prices go up, they go up because corporations need more money to cover what they give us. But they don’t need to do that.”

“Productivity gains over the past 20 years provide a buffer against the need to increase vehicle prices,” S&P Global Market Intelligence wrote in a note. For example, they calculated that a 46% raise for workers would increase firms’ costs by 2% over 4 years.

Automakers argue that these comparisons don’t factor in the cost of pension benefits the union is demanding, which automakers say carries a higher price tag. But it also doesn’t factor in the ways companies are cutting costs (including moving jobs out of the U.S.) to mitigate those impacts.

And this is completely dwarfed by recent price hikes.

According to Kelly Blue Book, over the past four years, car prices have risen an astonishing 30% before leveling off to an average of $49,000 for all vehicles and $65,000 for trucks.

Driving forces? Supply chain disruptions, lower production and a shift to fancier vehicles – not wages.